In a world where market volatility is the only constant, real estate investors are increasingly looking towards diversification strategies to safeguard their portfolios and amplify returns. As the landscape of property ownership evolves, savvy investors are not just resting on their laurels; thay are exploring innovative ways to leverage equity from their existing properties to fuel new opportunities. This article delves into the art of diversification, examining various strategies that can transform a singular investment approach into a robust portfolio. We’ll explore how tapping into the equity locked within current holdings can unlock doors to new ventures, ultimately leading to a more resilient and dynamic investment strategy.Join us as we navigate the principles and practices that can empower both seasoned investors and those just starting on their real estate journey.

Understanding Diversification: The Key to Resilient Real estate Portfolios

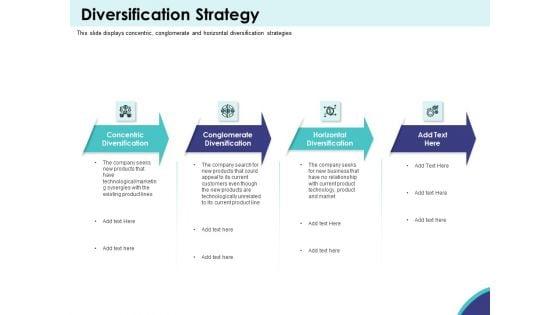

Diversification is not just a financial strategy; it’s a cornerstone of a resilient real estate portfolio. To effectively spread risk and capitalize on various market opportunities, investors can explore multiple strategies, such as:

- Geographic Diversification: Investing in properties across different locations can mitigate the impact of regional market downturns.

- Property Type Variation: Including a mix of residential, commercial, and industrial properties can enhance stability.

- Investment Styles: Engaging in both active real estate management and passive real estate investment trusts (REITs) provides multifaceted returns.

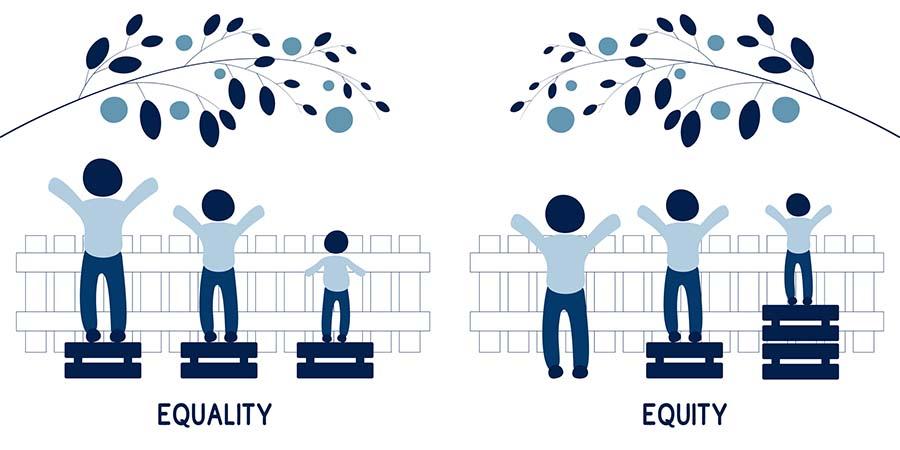

Leveraging equity from existing properties is a powerful tool for funding future investments while minimizing financial strain. Utilizing methods such as cash-out refinancing allows investors to extract value without selling. Consider this simple comparison of leveraging strategies:

| Strategy | Benefits | Considerations |

|---|---|---|

| Cash-Out Refinance | Access to larger funds | Increased monthly payments |

| Home Equity Line of Credit (HELOC) | Flexible borrowing | variable interest rates |

| Equity sharing | Lower upfront costs | Shared profits |

These strategies not only bolster an investor’s portfolio but also provide the necessary liquidity for pursuing new opportunities, further enabling a well-rounded approach to real estate investment that anticipates market fluctuations and optimizes growth potential.

Equity Extraction: Innovative Approaches to Unlocking Value in Existing Properties

In the world of real estate, equity extraction has emerged as a crucial strategy for property owners seeking to maximize the value of their existing investments. By employing innovative approaches, property owners can leverage their assets to create additional funds for diversification strategies. Some of these strategies include:

- Cash-Out Refinancing: Homeowners can refinance their mortgage to access a lump sum of cash based on their property’s increased value, allowing them to invest in new ventures.

- Home Equity Line of Credit (HELOC): This flexible borrowing option enables property owners to tap into their home equity as needed, providing liquidity for business opportunities or other investments.

- Rental Income Optimization: Enhancing the rental properties to increase cash flow can free up capital that can be reinvested elsewhere.

table 1 illustrates the potential returns from different equity extraction methods:

| Method | Initial Investment | Projected Return (%) |

|---|---|---|

| Cash-Out Refinancing | $10,000 | 8% |

| HELOC | $5,000 | 6% |

| Rental Income Optimization | $7,500 | 10% |

By creatively accessing the value locked in existing properties, investors can broaden their portfolios and mitigate risks. As the landscape of real estate continues to evolve, adopting these innovative techniques to extract equity can empower property owners to diversify effectively, ensuring sustained growth and stability in their investment endeavors.

Strategic Asset Allocation: Balancing Risk and Opportunity in Property Investment

When considering diversification strategies in property investment, it’s essential to explore various asset classes and geographical markets. Diversifying your portfolio by incorporating different property types can mitigate risks and enhance overall returns. **Residential, commercial, and industrial properties** often respond differently to market conditions, allowing investors to balance out fluctuations in performance. Investors should also consider allocating capital across various locations, reducing the impact of localized economic downturns. By broadening your investment horizons, you can tap into emerging markets or regions that boast strong growth potential, providing a safety net during economic uncertainties.

Leveraging equity from existing properties is another powerful strategy to fuel further investments and accelerate portfolio growth. By utilizing the accumulated equity in your properties, you can secure loans to purchase additional assets without needing a substantial upfront capital investment. **Key advantages of leveraging equity include:**

- Enhanced purchasing power for acquiring more properties.

- Access to capital for property improvements or renovations, potentially increasing rental income or property value.

- Tax benefits associated with mortgage interest deductions when reinvesting the funds.

To illustrate the potential impact of leveraging, consider the following table showcasing two property investment scenarios:

| Scenario | Initial property Value ($) | Equity Utilization ($) | New Property Acquired ($) |

|---|---|---|---|

| Scenario A | 300,000 | 60,000 | 250,000 |

| Scenario B | 500,000 | 100,000 | 400,000 |

This simplified example demonstrates how leveraging equity can enhance your portfolio by allowing you to acquire new assets while minimizing financial strain. Balancing risk and opportunity through strategic asset allocation is paramount for securing robust returns and long-term stability in a dynamic property market.

Navigating Market Trends: Adapting Diversification Strategies for Sustainable Growth

Diversification strategies are crucial in today’s fluctuating market, enabling investors to mitigate risks while pursuing new opportunities. By carefully assessing market trends,investors can allocate resources effectively across various asset classes. Here are some effective approaches to consider:

- Property Types: Invest in a mix of residential, commercial, and industrial properties to balance risk and returns.

- Geographic Diversification: Explore different regions or cities to capitalize on varying local markets and economic conditions.

- Investment Partnerships: Collaborate with other investors to pool resources and share expertise in new ventures.

leveraging equity from existing properties is a strategic move that can significantly enhance your investment portfolio. Utilizing funds from equity allows for the acquisition of additional properties or reinvestment into renovations that can increase value. Strategies to maximize this approach include:

| Strategy | Description |

|---|---|

| Home Equity Loans | Borrow against the equity of current properties for investment in new assets. |

| Cash-out Refinancing | Refinance existing loans to access extra cash for expansion. |

| Equity Partnerships | Form partnerships to leverage equity for joint purchases and enhance cash flow. |

Closing Remarks

the world of real estate offers a myriad of opportunities for those willing to think strategically about diversification and leverage. By skillfully navigating the intricacies of property investment, investors can enhance their portfolios, mitigate risks, and unlock hidden value within their existing assets. As you explore diversification strategies—be it through geographic expansion, property type diversification, or even incorporating alternative investments—remember that the key lies in aligning your approach with your financial goals and risk tolerance.

Moreover, leveraging the equity from your current properties not only provides a means to further your investment aspirations but also paves the way for innovative solutions and new ventures. Whether you’re a seasoned investor or just starting, embracing these strategies can transform your real estate journey into a dynamic and rewarding experience.

As you ponder your next steps in this evolving landscape, let the principles of diversification and equity leverage serve as your guiding stars—illuminating a pathway toward sustainable growth and enhanced financial independence. Happy investing!